“Shocking Twist: Santander’s Mortgage Rates Flip in Just 5 Days! What You Need to Know Now!”

Name: know-how santander’s loan charge modifications

Santander, a chief participant inside the mortgage marketplace, recently made headlines by way of adjusting its constant-charge loan offers. In only five days, the bank determined to increase hobby fees, a stunning pass thinking about they had only lately slashed them. Let’s smash down what this means for homebuyers and what is probably driving santander’s decision.

Santander, a chief participant inside the mortgage marketplace, recently made headlines by way of adjusting its constant-charge loan offers. In only five days, the bank determined to increase hobby fees, a stunning pass thinking about they had only lately slashed them. Let’s smash down what this means for homebuyers and what is probably driving santander’s decision.

What occurred?

Last week, santander caught our attention through reducing quotes on numerous constant-charge deals. As an instance, its -year constant fee went from four.55 percentage to four.1 percentage, right away becoming a top preference for plenty. However, in a twist of activities, the financial institution is now growing all constant-fee deals for each homebuyers and those seeking to remortgage.

How a great deal are the will increase?

If you’re worried approximately skyrocketing rates, take a breath. Santander’s price hikes are exceedingly modest, starting from just 0.05 to 0.2 percentage factors. Moreover, the bank is pulling lower back on some specific deals, such as those tailor-made for first-time homebuyers and a 3-yr fixed-rate alternative for those with a ten percentage deposit.

Why the change?

The huge query on all and sundry’s thoughts is: why is santander doing this? Properly, economic specialists warned us that the era of falling mortgage rates might be coming to an end. This warning came after a surprise growth in inflation, with december’s studying hitting 4 percentage—barely higher than the predicted 3.Eight percentage. This surprising inflation bump led economic markets to reconsider their expectancies for base price cuts within the coming 12 months.

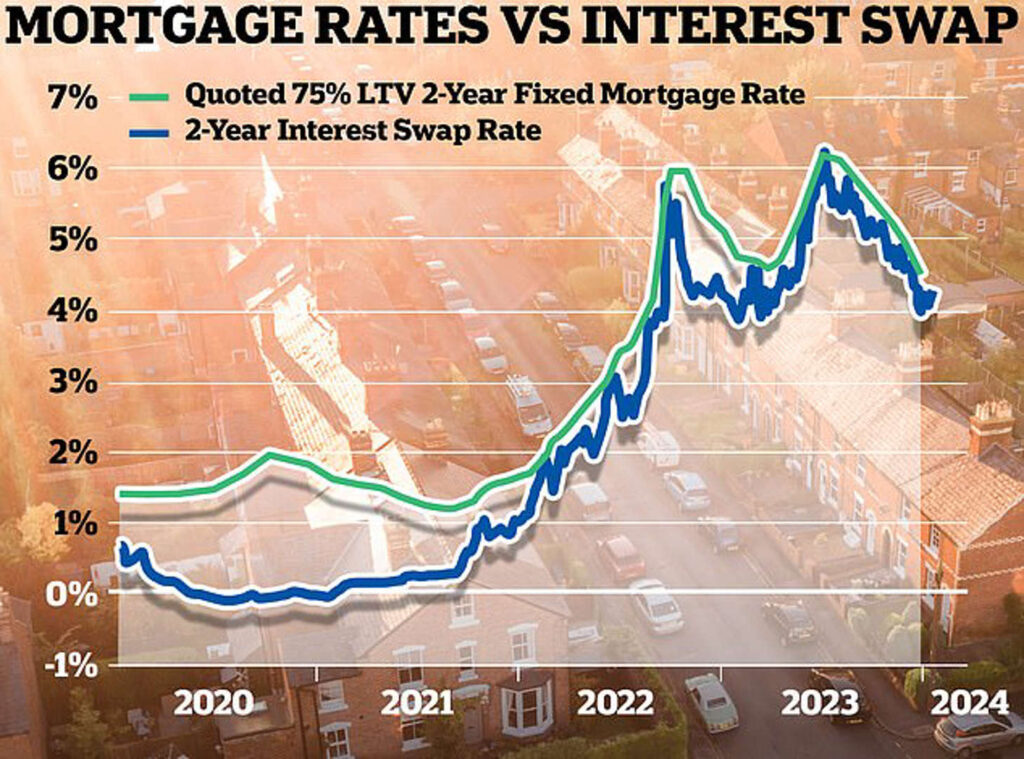

What are swap fees, and why do they be counted?

To apprehend santander’s pass, we need to take a look at some thing called “change costs.” these fees suggest what banks and constructing societies consider destiny interest fee traits, assisting them decide on fixed-charge pricing. Presently, five-yr swaps are at three.69 percentage, and -yr swaps are at 4.25 percent—both decrease than the present base price. But, these numbers have long gone up from 3.4 percentage and four.04 percent at the beginning of the 12 months.

Will there be greater rate increases?

Mortgage advisors point out that it is pretty unusual for the lowest mortgage quotes to dip beneath switch fees. Santander did exactly that with its 4.1 percent -yr restoration, which become cheaper than the 4.25 percentage two-12 months switch rate. Some creditors have already replied to the current uptick in change quotes through growing their own prices. But, it is now not all doom and gloom—other lenders would possibly nevertheless introduce greater inexpensive deals, although they may limit availability temporarily as borrowers and agents scramble for options.

Is that this just a blip?

Professionals advise that while the loan marketplace may also see some americaand downs within the coming weeks, debtors should not be overly worried. They emphasize the importance of operating with mortgage brokers who can navigate the changing marketplace and advocate potential debtors to have their files equipped for packages to keep away from any hiccups.

What might be at the back of santander’s pass?

What might be at the back of santander’s pass?

A few mortgage agents believe santander’s decision to growth costs might be greater approximately dealing with a surge in patron programs than signaling a considerable shift in mortgage prices. In keeping with david sharpstone, director at cis loan recommendation, santander has a records of suffering with inconsistent carrier tiers. After they open the floodgates to applications, the time it takes to process them decreases. So, this circulate could be more about coping with the software technique efficiently as opposed to expressing broader market concerns.

Conclusion: navigating the loan marketplace

In conclusion, santander’s short change in loan fees highlights the dynamic nature of the mortgage market. It’s stimulated by using different factors, including inflation, change quotes, and the sheer extent of consumer applications. For ability homebuyers, staying knowledgeable and working intently with mortgage brokers is essential in navigating those market shifts. While there is probably occasional bumps in the road, the overall fashion of rate discounts is expected to keep. So, maintain an eye fixed available on the market, be organized, and don’t permit quick-term fluctuations cause needless fear to your homebuying adventure.