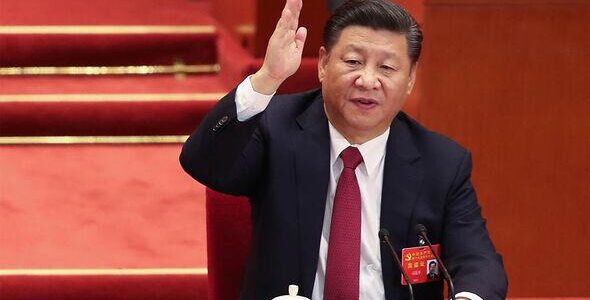

China Debt Bailout: The Hidden 1000X Potential?

China Debt Bailout: A Risky Gamble? China’s recent announcement of a massive £1.1 trillion debt bailout has sent shockwaves through global financial markets. This bold move is aimed at propping up the country’s slowing economy, particularly in the face of…

“UK Budget Impact on Bank of England Rate Cuts: 5 Surprising Benefits!”

UK Budget Impact on Bank of England Rate Cuts This story explores the UK budget’s impact on Bank of England rate cuts, highlighting how recent fiscal policies affect inflation and monetary policy expectations. The UK budget impact on Bank of…

Bank of England Interest Rate Cuts: 5 Exciting Benefits Await!

Bank of England Interest Rate Cuts are becoming a topic of discussion as inflation decreases. This article explores the implications of these cuts and the Bank’s cautious approach. Bank of England Interest Rate Cuts Bank of England Interest Rate Cuts…

UK Interest Rate Cut 2024: 5 Incredible Benefits for Your Wallet

UK Interest Rate Cut 2024: What You Need to Know UK Interest Rate Cut 2024 marks the first reduction in over four years, impacting savings, mortgages, and economic forecasts. UK Interest Rate Cut 2024 In a significant move, the Bank…

Capital Gains Tax Reform: 5 Ways to Empower Social Benefits

Discover why the International Monetary Fund suggests raising capital gains taxes for increased welfare spending amidst technological changes. Read more on the implications and political responses in the UK. This rewritten blog post maintains clarity and adheres to a human-friendly…

“Wealth Tax Reform: 5 Powerful Steps to Economic Justice!”

Wealth Tax Reform: A Necessity for Economic Stability and Social Justice Wealth tax reform is crucial for economic stability and social justice. Discover why Labour must adopt radical new taxes on wealth and capital gains to secure a brighter future…

“UK Interest Rate Cut Summer 2024: 5 Exciting Benefits for Borrowers!”

UK Interest Rate Cut Summer 2024: What You Need to Know UK interest rate cut summer 2024: The Bank of England may reduce borrowing costs in response to falling inflation, as explained by Deputy Governor Ben Broadbent. Overview UK interest…